What is a Stock Average Calculator?

The Stock Average Calculator is a user-friendly online tool designed to help investors calculate the average cost of their stock purchases. By inputting the quantity and price of shares from different transactions, users can quickly determine the weighted average cost per share. This tool simplifies complex calculations, saving time and ensuring accuracy, especially for those managing large portfolios or frequently buying and selling stocks.

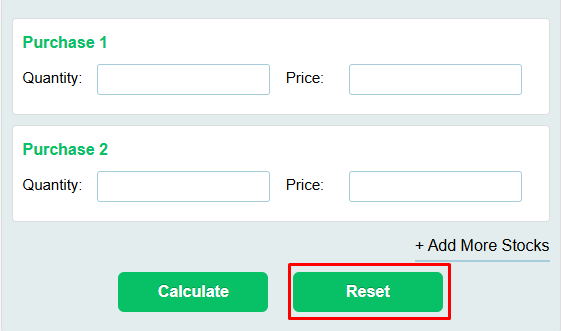

How to Use the Stock Average Calculator

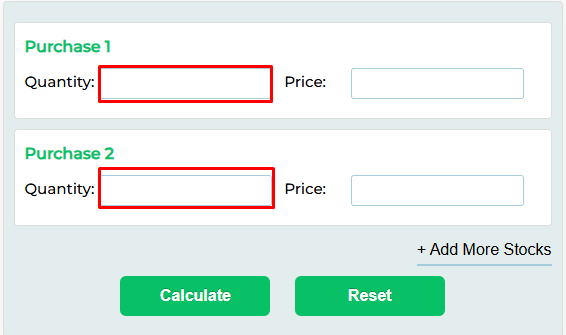

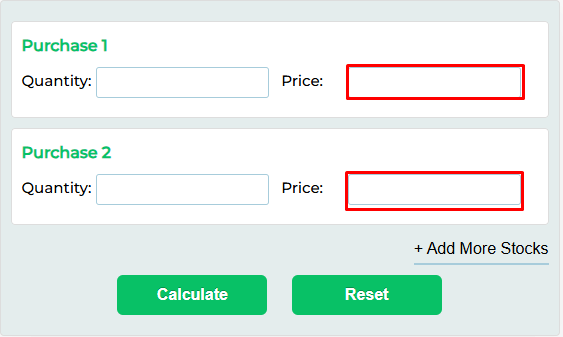

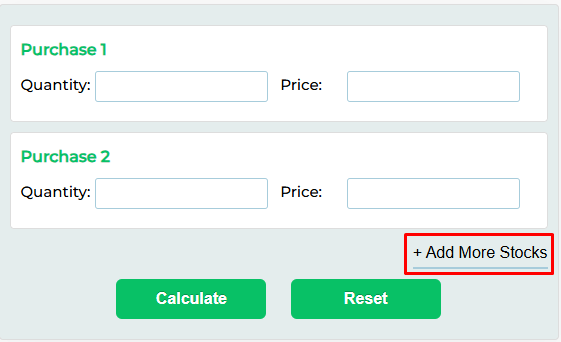

Using the Stock Average Calculator is straightforward. Follow these simple steps:

-

Enter Share Quantity: Input the number of shares you bought in each transaction.

-

Enter Purchase Price: Provide the price you paid per share for each batch.

-

Add Additional Stock Entries (Optional): If you made mode than two purchases, you can add more enteries.

-

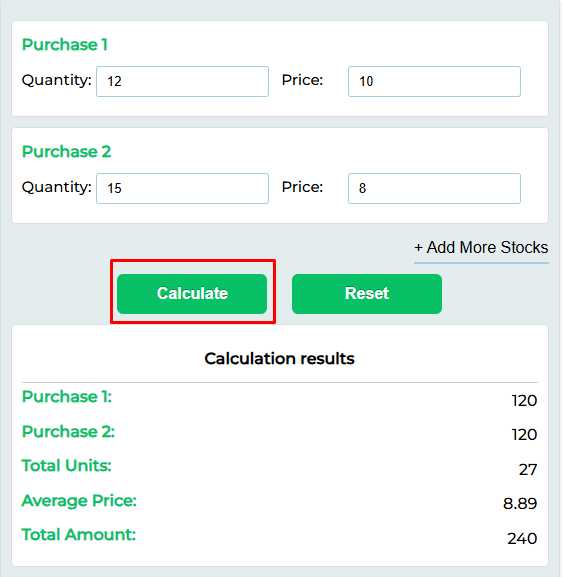

Calculate Average: Click the "Calculate" button to get the average cost per share.

-

Reset for New Entries: Use the "Reset" button to start fresh with a new set of data.

Example of Using the Stock Average Price Calculator

Imagine these transactions:

- 100 shares at $50 each

- 150 shares at $40 each

- 50 shares at $60 each

Here’s the calculation:

- Total shares: 100 + 150 + 50 = 300

- Total cost: (100 x $50) + (150 x $40) + (50 x $60) = $5,000 + $6,000 + $3,000 = $14,000

- Average price per share: $14,000 ÷ 300 = $46.67

The average price of your shares is $46.67.

Why You Should Use a Stock Average Down Calculator

Accuracy in Financial Planning

Manual calculations can lead to errors, especially with multiple transactions. A Stock Average Calculator ensures precision, giving you confidence in your financial decisions.

Time Efficiency

By automating calculations, this tool saves valuable time for investors, allowing them to focus on strategy and analysis.

Strategic Decision-Making

Knowing your average cost per share enables you to make better-informed decisions about buying, selling, or holding stocks.

Free Accessibility

Our Stock Average Calculator is completely free and available online, ensuring accessibility for all types of investors.

Key Features of Our Online Free Tool

- Multi-Transaction Support: Handles multiple purchases seamlessly.

- Fractional Shares: Supports fractional share entries for precision.

- Real-Time Results: Instantly computes your average cost per share.

- Currency Flexibility: Works with various currencies to cater to global users.

- User-Friendly Design: Intuitive interface suitable for all experience levels.

Tips for Using the Average Calculator Tool

- Keep Records Handy: Ensure you have accurate data on share quantities and prices.

- Use Regularly: Update your calculations after every transaction to maintain an accurate average.

- Combine with Analysis: Use the results alongside market analysis to make strategic investment decisions.

- Avoid Emotional Investing: Rely on data, not emotions, when using the calculator.

How Does Our Stock Average Down Calculator Work?

The calculator uses a simple formula:

Average Price Per Share = Total Cost of Shares ÷ Total Number of Shares

By summing up the cost of all transactions and dividing it by the total number of shares, the calculator delivers a precise weighted average cost.

The Importance of Calculating Stock Average Price

1. Portfolio Optimization

Accurate average prices help in monitoring and optimizing your portfolio effectively.

2. Strategic Buying

Knowing your average cost enables you to identify the right opportunities to average down or take profits.

3. Tax Reporting

Accurate calculations simplify tax reporting and compliance.

Advantages of Using a Stock Average Price Calculator

- Simplifies Complex Calculations: Eliminates manual errors and complexities.

- Enhances Investment Decisions: Provides clarity on cost basis and profitability.

- Improves Financial Tracking: Keeps your portfolio data organized and up-to-date.

- Saves Time: Instant results allow more time for analysis.

Common Mistakes to Avoid When Average Down the Stock Price

- Ignoring Market Fundamentals: Always analyze the company’s performance and market conditions.

- Overcommitting Capital: Avoid investing more than you can afford to lose.

- Failing to Diversify: Concentrating too much on one stock increases risk.

- Neglecting Updates: Regularly update your calculations for accuracy.

What is Averaging in the Stock Market?

Averaging involves buying additional shares of a stock at varying prices to reduce the average cost per share. This strategy is particularly effective during market downturns, allowing investors to accumulate shares at lower prices and enhance long-term returns.

You can also check our Mortgage Recast Calculator to calculate how much you could save on your monthly payment and total interest by recasting your mortgage.

The Pros and Cons of Averaging Down the Stocks

Pros

- Reduces Cost Basis: Lowers your average price per share.

- Increases Potential Returns: Enhances profitability when stock prices rebound.

- Encourages Long-Term Investing: Focuses on future growth rather than short-term fluctuations.

Cons

- Requires Additional Capital: Demands further investment.

- Potential for Loss: Increases exposure to underperforming stocks.

Averaging Down the Stock

Averaging down involves purchasing more shares of a stock when its price declines. This strategy is useful for investors with strong conviction in a company’s fundamentals, aiming to reduce their cost basis and improve future profitability.

The Mathematics of Averaging Down

The formula for averaging down:

New Average Price = (Current Total Cost + Additional Investment) ÷ Total Shares

Example:

- Initial: 100 shares at $50 = $5,000

- Additional: 50 shares at $40 = $2,000

- New Average Price: ($5,000 + $2,000) ÷ 150 = $46.67

The Importance of Tracking Purchases

Accurate tracking of share purchases and prices ensures you have reliable data for:

- Portfolio management

- Strategic averaging

- Tax reporting

- Long-term planning

Strategic Approaches to Averaging Down

- Analyze Fundamentals: Ensure the company has strong growth potential.

- Set Clear Limits: Define how much capital you’re willing to invest.

- Diversify Investments: Avoid overexposure to a single stock.

- Stay Informed: Monitor market conditions and company performance.

Utilizing the Average Down Calculator

The Share Average Calculator is an essential tool for investors practicing averaging down. By providing instant, accurate results, it helps you plan and execute your investment strategy effectively.

Understanding Volume-Weighted Average Price (VWAP)

VWAP is another useful metric for investors. It calculates the average price of a stock based on volume and price over a specific time period. While the Stock Average Calculator focuses on cost basis, VWAP provides insight into market trends and trade efficiency.

Profitability Analysis and Cost Basis

Calculating your cost basis is crucial for:

- Determining break-even points

- Assessing profitability

- Making informed buy/sell decisions

The Stock Average Calculator simplifies this process, providing clear insights into your financial standing.

Tax Implications of Stock Sales

Knowing your cost basis is essential for accurate tax reporting. The Stock Average Calculator helps you:

- Identify gains and losses

- Prepare for tax season

- Avoid penalties for incorrect filings

Frequently Asked Questions (FAQs)

What is a Stock Average Calculator?

It’s a tool that calculates the average cost per share of multiple stock purchases.

Is the Stock Average Calculator free to use?

Yes, it’s completely free and accessible online.

Can it handle fractional shares?

Absolutely. The calculator supports fractional share entries for precise calculations.

Why is averaging down important?

Averaging down reduces your cost basis, increasing potential returns when stock prices rebound.

Does the calculator support multiple currencies?

Yes, it accommodates various currencies for global investors.

Conclusion

The Stock Average Calculator is an invaluable tool for investors aiming to optimize their portfolios and make informed decisions. Its ease of use, accuracy, and advanced features make it essential for managing stock purchases and planning future investments.

Also check our House Flipping Calculator to calculate your net profit after flipping a house.